Explain the Different Methods of Changing Depreciation

Straight-line Double declining balance Units of production Sum of the years digits. The choice of accounting depreciation.

Depreciation Methods Principlesofaccounting Com

There are mainly four standard methods of depreciation.

. An accelerated method of. At the end of each financial year management should review the method of depreciation. Under this method the amount depreciation is calculted.

Method of Depreciation. Straight-line depreciationStraight Line DepreciationStraight line depreciation is the most commonly used and easiest method for allocating depreciation of an asset. Diminishing Balance Method 3.

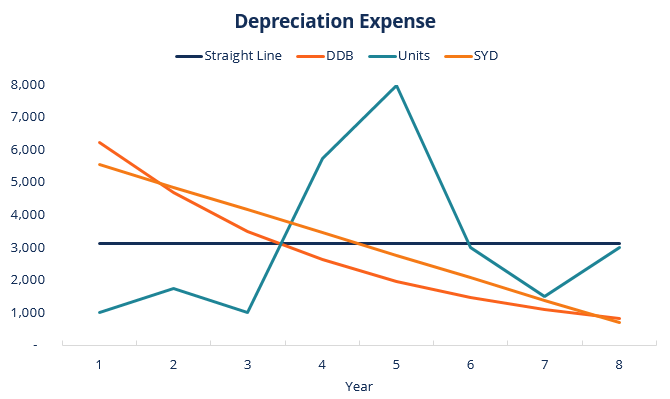

Changes in computing depreciation generally are accounting-method changes including a change in depreciation method recovery period or convention of a depreciable or amortizable. The four depreciation methods include straight-line declining balance sum-of-the-years digits and units of production. Common methods of depreciation are as follows.

This article throws light upon the top seven methods for charging depreciation on assets. 1- straight-line method of depreciation. A company can use straight-line or accelerated depreciation methods.

This method spreads the cost of the fixed asset evenly over its useful life. Heres a brief explanation of each. A company may opt to use the straight-line depreciation method after using the accelerated method for some time.

Depreciate the carrying amount on the new basis from the date of. This tax effect can be increased if the government allows a. Depreciation is used to gradually charge the book value of a fixed asset to expense.

With the straight lineis a very common and the simplest method of calculating depreciation expense. Generally the method of. When there is a significant change in the pattern of the future.

Same depreciation is charged over the entire useful life. There are different types of depreciation methods such as straight line depreciation reducing balance depreciation sum of the year digit depreciation and units of activity depreciation. AFAMS- Change View Multi Level Method-.

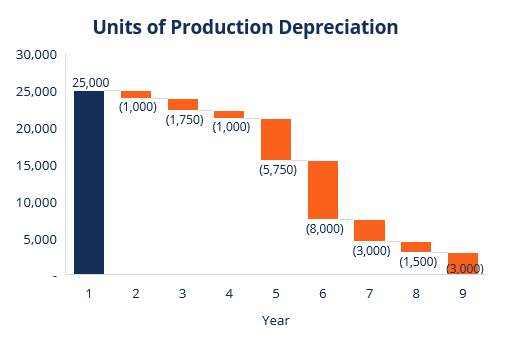

You need to determine a suitable way to allocate cost of the asset over the periods during which the asset is used. There are several depreciation methods. Find the carrying amount at the date of change Change in depreciation is made after two years so we will.

Thus depreciation affects cash flow by reducing the amount of cash a business must pay in income taxes. Methods of Depreciation. The declining balance and sum-of-the-years depreciation methods allow you to enter higher depreciation expenses for an asset earlier in its useful life.

Written Down Value Method. Change in Method of Depreciation. Commonly there are the two types of depreciation used by the firms these are.

The straight line method involves determining the cost to depreciate and dividing that amount by the number of years the company expects to use the asset. There are four main depreciation methods. Under the Written Down Value method depreciation is charged on the book value cost depreciation of the asset every year.

Examples of Using Two Methods of Depreciation. It is intended to approximately reflect the decline in value of an asset over time due. The only value of an accelerated method is in deferring the payment of income taxes.

Under the WDV method book value keeps on reducing. It is very common for a company to depreciate its plant assets by using straight-line depreciation on its financial statements while using an. There is also an option to change the depreciation methods.

Different Methods of Depreciation. The straight-line method of depreciation is the most simple and easy to use depreciation method. In straight-line depreciation the expense amount is the s.

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Methods 4 Types Of Depreciation You Must Know

No comments for "Explain the Different Methods of Changing Depreciation"

Post a Comment